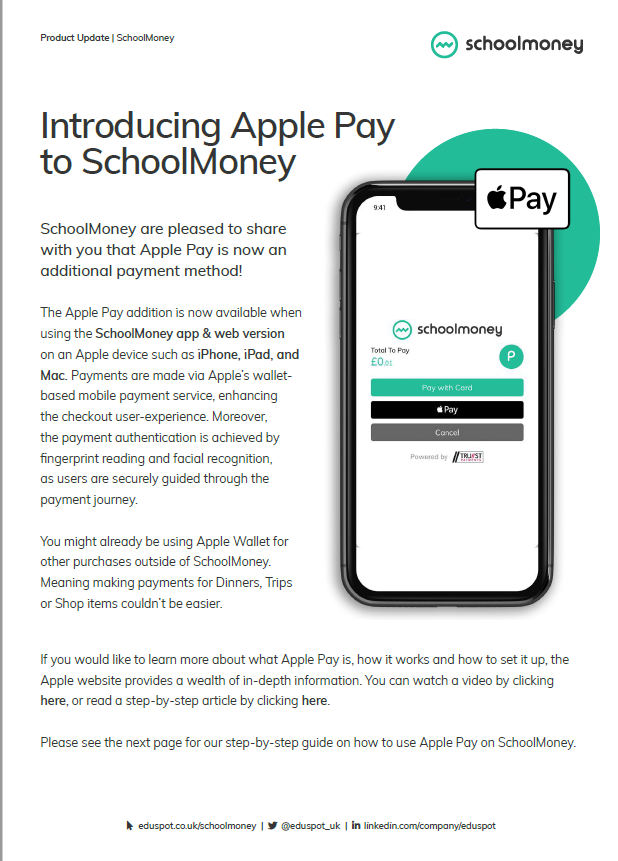

In the academic year beginning on September 4th 2021, SchoolMoney analysis has reported that nearly 60% of all current customers accessing SchoolMoney use an Apple device. The introduction of Apple Pay, taking these figures into account, is a welcome feature addition for both our schools and their parents.

Some parents will already be using Apple Pay to pay for items and services outside of SchoolMoney. However, there may be some who are yet to set up Apple Pay on their device and would like more information. This article is to provide you with further detail, so that you are fully informed, and therefore empower you to make the best decision when making payments on SchoolMoney.

Below you’ll find some further information about what Apple Pay is, its security, how it works and what you need to do to add Apple Pay to your mobile device. You’ll also find a helpful link that lists compatible devices.

Apple Pay gives you the security benefit of a digital wallet, making payments for meals, clubs, and shop items even more convenient.

Apple Pay is designed to allow you to pay for items replacing your card’s details with a token, removing the requirement of having to enter card information. The Apple Pay digital wallet makes some of the credit card information visible to the user of the mobile device. However, the full number and card verification code (CVC) is never exposed to the payer, school or SchoolMoney. That’s to say the card data is encrypted, and any real information is never shared during purchases. Therefore, payments are more secure with a lower risk of fraudulent activity.

The card information is only released if authorised in response to information being stored within a secure and separate processor, called a secure enclave, on the device itself. This encryption creates an embedded 3D Secure authentication.

It is suggested in the payments industry that Apple Pay is as secure as contactless card payments, due to card details being encrypted on your iPhone, meaning that detail is not shared with Apple’s servers. In addition, Face ID and Touch ID recognition provide further security measures. Noted that also wrist detection must be enabled on Apple Watches.

Click here to see what devices are compatible.

In addition, Which? suggests that similar protection exists regarding Section 75, as long as you are using a credit card via your Apple Pay digital wallet and only if items cost between £100 and £30,000, you are covered.* An example being, if you don’t receive what you have paid for, you can claim the cost back from the card company. Furthermore, Chargebacks also covers mobile payments if the payment is lower than £100, or if a debit card is used.

Using Apple Pay as a payment medium is not the only choice. Parents can continue to use traditional card payment methods or a mixture to pay for SchoolMoney items. The addition of Apple Pay and the pending release of Google Pay gives customers more choice, with the benefit of using a level 1 PCI compliant payments facilitator such as SchoolMoney. This provides trust and reassurances that you are in safe hands from browsing to buying.

*Please note: if using an intermediary card such as Curve, Apple and Google Pay will not be covered by these protections.